Daily Commentary

Commentary prepared by Alloya Investment Services, a division of the wholly owned CUSO of Alloya Corporate Federal Credit Union. Alloya Investment Services is a leading broker/dealer consultant to credit unions.

Thursday, April 25, 2024 at 8:00 am CT

Commentary prepared by Tom Slefinger, SVP, Director of Institutional Fixed Income Sales, Registered Representative of ISI*, Alloya Investment Services

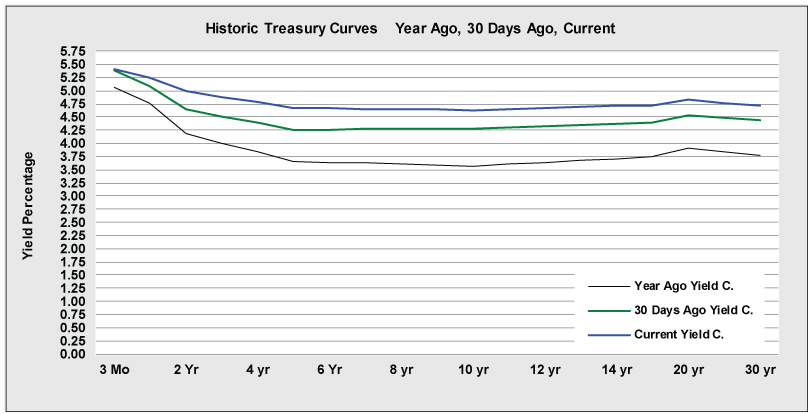

Market Indications

Other Market Indicators

| Market Indicators | ||

|---|---|---|

| 2s/5s Tsy Spread | -0.27 | -0.01 |

| 2s/10s Tsy Spread | -0.27 | +0.01 |

| 2s/30s Tsy Spread | -0.13 | +0.02 |

| DJIA-30 | 38,460.92 | -42.77 |

| S&P-500 | 5,071.63 | +1.08 |

| NASDAQ | 15,712.75 | +16.11 |

| Dollar Idx | 105.84 | +0.17 |

| CRB Idx | 297.54 | -0.54 |

| Gold | 2,315.91 | -6.09 |

Daily Commentary

Recap – Equities start the day on their back foot, as the U.S. earnings reports after the close came in on the soft side. U.S. futures are moderately in the red. Bonds are stable with the 10-year Treasury rate at 4.65%. By the way, there was no buyers strike at yesterday’s record $70 billion 5-year note auction. On tap today is the huge $44 billion 7-year Treasury note sale at 1:00 pm ET.

All eyes today are laser-focused on the U.S. Q1 gross domestic product (GDP) data (at 8:30 am ET). The consensus is at +2.5% (annualized growth) if one goes by the Atlanta Fed Nowcast model hook, line and sinker. Even still, it does beg the question as to just how red-hot the U.S. economy really is when UPS (the company that ships GDP to the country) posts yet another decline in quarterly revenue as the company delivered fewer packages in the past three months. Overall revenue fell -5.3% in the first quarter, with shipping volume down -3.2% in the U.S. Revenues declined -5.3% year-over-year while net income plunged -36% to $1.22 billion. That report was followed by PepsiCo, which posted a -2% drop in volume sales. This does make you wonder as to what it means when the consumer begins to pull back on soft drinks, potato chips, granola bars and cereal.

Consumer credit stress appears to be spreading. Following in the footsteps of Bank of America and Discover, Synchrony Financial (a player in the “Buy Now, Pay Later” space) reported rising loan loss provisions and write-offs. The company set aside nearly $2 billion in new provisions against credit losses, surging nearly +50% compared to last year. This is the most on record (Bloomberg data back to 2012) and brings the total over the past year to a whopping $6.6 billion. Delinquency rates for loans that are 30+ days past due are up to 4.7% from 3.8% a year ago, while net charge-offs, at 6.3%, jumped +180 basis points over this time (also a record high).

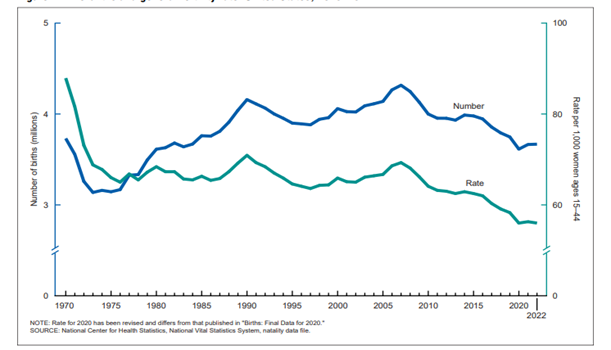

Some have stated that the “neutral” fed funds rate is higher than the Fed’s own 2.85%. Many point to the fact that the U.S. is experiencing an immigration boom as a source of a higher neutral Fed funds rate. But here’s the thing: immigration is acting as an offset to a decline in the home-grown native population. To wit: The U.S. fertility rate declined -2% in 2023 to a record low (back to the 1930s) of 1.62 births per woman with the largest retreat among younger females as they delay the decision to get married and have children like never before. The actual number of births in 2023 was the lowest for any year since 1979.

Source: National Center for Heath Statistics, National Vital Statistics System, natality data file

Finally, as a follow up to this past week’s Weekly Relative Value (WRV), while inflation is on everyone’s mind and contrary to popular opinion, there is no broadly based inflation in the United States. It has become narrowly based in areas that the Fed has no control over. The recent strength in the monthly Consumer Price Index (CPI) data was due to auto insurance (given the surge in claims), rents (the lagged manner in which they are calculated in the CPI) and health care premium. Indeed, the real inflation is in healthcare maintenance organizations (HMOs). Have a read of the Wall Street Journal article: “The True Cost of Megamergers in Healthcare: Higher Prices”. All three of these costs (auto insurance, housing and healthcare) act more as de facto tax increases on consumer purchasing power than anything else.

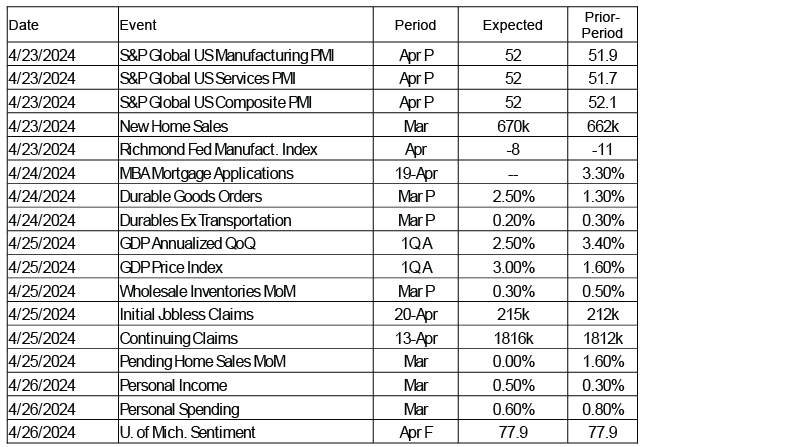

On the docket this morning, and as noted above, the highlight is the Q1 GDP report. In addition to the GDP report and a busy day of corporate earnings, the Treasury will auction $44 billion of seven-year notes, the final leg in what’s been a heavy week of new supply.

Have a great day!

Economic Calendar

April 22 - 26, 2024: The Week Ahead

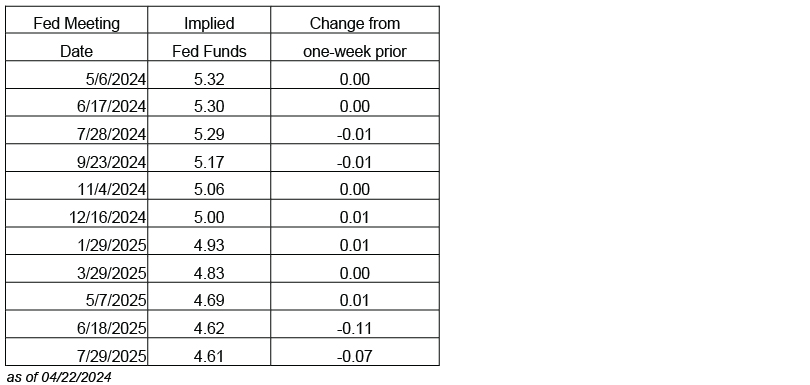

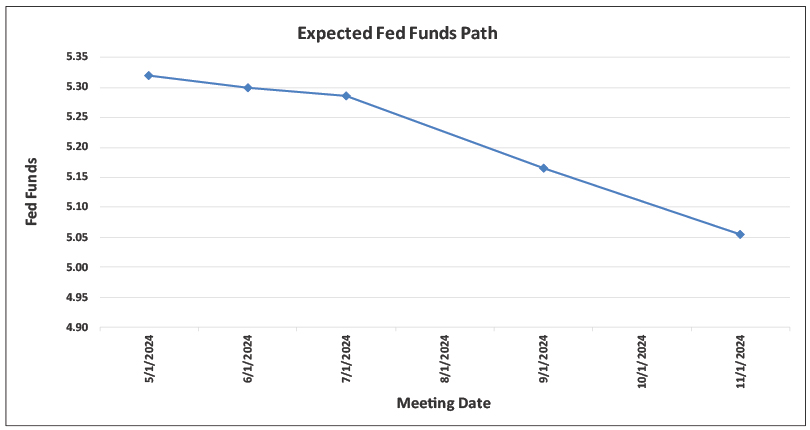

Future Fed Expectations

Source: Bloomberg

| Select Probabilities based on the Futures | |

|---|---|

| Probability of Fed Funds rate CUT on May 1. 2024 | -3% |

| Probability of Fed Funds rate CUT on June 12, 2024 | -16% |

**All quoted rates are indications and are subject to change without notice.

* ISI is a member of the FINRA/SIPC.

The information contained herein is prepared by ISI Registered Representatives for general circulation and is distributed for general information only. This information does not consider the specific investment objectives, financial situations or particular needs of any specific individual or organization that may receive this report. Neither the information nor any opinion expressed constitutes an offer, or an invitation to make an offer, to buy or sell any securities. All opinions, prices, and yields contained herein are subject to change without notice. Investors should understand that statements regarding future prospects might not be realized. Please contact Alloya Investment Services to discuss your specific situation and objectives.